It’s my favorite time of year. I do love celebrating the harvest as much as the next guy – but I really love November because the SEC Enforcement Report is published. If you work in securities, or have an affinity for all things Ponzi scheme (like me) – it’s a wonderful season. This post is about the SEC’s annual enforcement report and one of my favorite topics in white collar crime: the Ponzi scheme. Read on for more information.

The Enforcement Report

For the uninitiated – the Securities and Exchange Commission is the government agency tasked with regulating the offering and sale of securities within the United States. When startup companies raise money from VC’s and “angels” they are (usually) doing so by way of an exemption to the “normal” SEC rules that govern such transactions. Part and parcel of “regulation” is enforcement of said regulations, so thus, we have the SEC Enforcement Report.

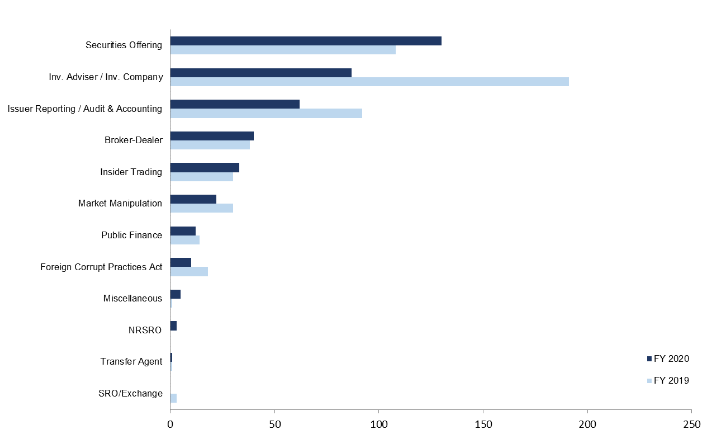

In 2020, the SEC brought a total of 715 enforcement actions against various individuals and entities; 405 of which were standalone cases. (Standalone cases are those the SEC brought of its own volition, not as a follow-up to a criminal case, or actions related to delinquent filings.) As the chart below illustrates, the majority of the SEC’s 405 standalone cases in 2020 concerned securities offerings (32%), investment advisory and investment company issues (21%), and issuer reporting/accounting and auditing (15%) matters. The SEC also continued to bring actions relating to broker-dealers (10%), insider trading (8%), and market manipulation (5%), as well as other areas such as Public Finance (3%) and Foreign Corrupt Practices Act (2%).

But, what does that really mean? Ponzi schemes abound!

My biggest takeaway from the report each year is, “wow, there are a ton of Ponzi schemes going on all over the place,” and this year is no different. Of the 32% of total enforcement actions dedicated to “Securities Offerings,” many are what would be considered Ponzi schemes – along with a peppering in the other categories. It’s clear, these schemes are not a relic of the 70’s or reserved for “big names” like Madoff or Dreier – so it pays to know the red flags (from Investor.gov):

- High returns with little or no risk. Every investment carries some degree of risk, and investments yielding higher returns typically involve more risk. Be highly suspicious of any “guaranteed” investment opportunity.

- Overly consistent returns. Investments tend to go up and down over time. Be skeptical about an investment that regularly generates positive returns regardless of overall market conditions.

- Unregistered investments. Ponzi schemes typically involve investments that are not registered with the SEC or with state regulators. Registration is important because it provides investors with access to information about the company’s management, products, services, and finances.

- Unlicensed sellers. Federal and state securities laws require investment professionals and firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms.

- Secretive, complex strategies. Avoid investments if you don’t understand them or can’t get complete information about them.

- Issues with paperwork. Account statement errors may be a sign that funds are not being invested as promised.

- Difficulty receiving payments. Be suspicious if you don’t receive a payment or have difficulty cashing out. Ponzi scheme promoters sometimes try to prevent participants from cashing out by offering even higher returns for staying put.

As an entrepreneur it also pays to keep in mind what the SEC’s enforcement priorities are – and to ensure that your company does not run engage in any behavior that could point to impropriety (often, the result of being disorganized). Yes, founders (and their lawyers) should take solace in the fact that 32% of enforcement actions weren’t for filing an incorrectly filled out Form D’s – but many hinged on incorrect (or sloppily prepared) financial statements. Maybe it’s a good idea to get those in order and up to GAAP standards – Ponzi scheme or not.

Thanks for reading.